VoidableTransactions.com HomePage

HomePage

VOIDABLETRANSACTIONS.COM

INTRODUCTION TO WEBSITE

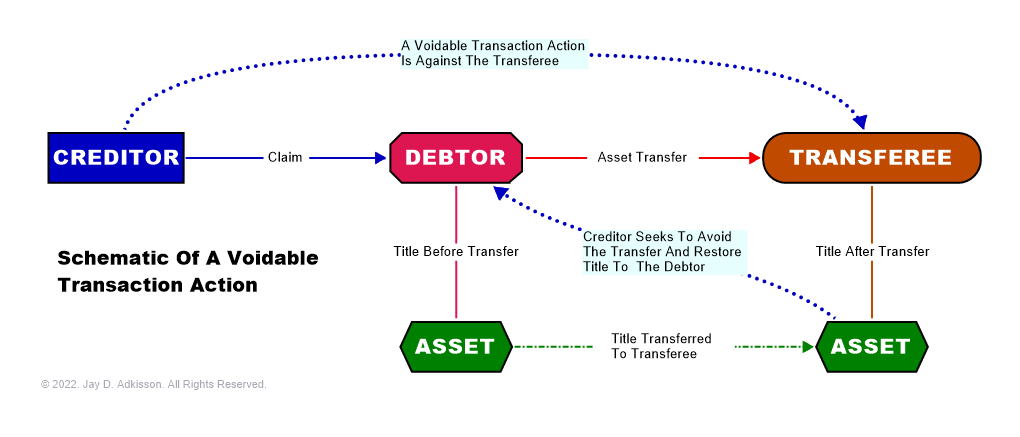

The purpose of this website is to explore and elucidate upon voidable transaction law (was: fraudulent transfer law). As a litigator who, at the time of this writing, has dealt with fraudulent transfer law for over 30 years, both on the creditor and debtor sides more-of-less evenly, I have written commentary and attempted to re-organize the treatment of this body of law in a way that is friendly to, well, litigators. When possibly, I have also tried to include material to explain why various provisions exist and what they were meant to do. Understanding the why will almost invariably lead to a much better understanding of how the law operates as it does.

This website also focuses mostly on garden-variety fraudulent transfers. The net of the fraudulent transfer laws is cast broadly, and picks up transfers as diverse as the reorganization of a financially-distressed mega-conglomerate, as well as the creditor who is simply trying to get the debtor's former Bentley back from his wife's cousin who bought it for $1 two weeks before trial. It is the latter type of transactions that is the focus of this website; probably those who deal with the former type of transactions will feel that the treatment of this website is too pedestrian, but truthfully those litigators likely know this body of law as it relates to those special types of cases far better than your writer ever will, and so they will be left to their own study. This website is aimed at getting the Bentley back.

There are no less than five bodies of fraudulent transfer law in the United States, being:

Notably, the law of fraudulent transfers changes not just with the statutory law, but also with the numerous court opinions which come out daily on the subject, and so this website should be viewed as no more than the starting point in the analysis of a fraudulent transfer issue, and nothing like its conclusion. When possible, I try to keep up with the most important new opinions dealing with fraudulent transfer issues, mostly in my Forbes.com column, and this references to this commentary is included throughout this website.

I hope that you find it useful. Comments and suggestions to me at jay [at] jay.com are always welcome.

WHERE TO START?

Litigators attempting to analyze a possible voidable transaction case are encouraged to start with the UVTA Decision Path.

About The Author

Jay Adkisson is admitted to practice law in Arizona, California, Nevada, Oklahoma and Texas. He graduated from the University of Oklahoma College of Law in 1988 and was a member of the Oklahoma Law Review. Twice an expert witness to the U.S. Senate Finance Committee, Jay is also an honorary member of the California Association of Judgment Professionals and a lifetime member of the National Association of Estate Planners & Councils. His books include The Charging Order Practice Guide (ABA 2019) and Asset Protection: Concepts & Strategies (McGraw-Hill 2004), and Jay is currently the Wealth Preservation commentator to Forbes.com. Jay has also served as an American Bar Association section adviser to the drafting committees of the following uniform acts:

- Uniform Voidable Transaction Act

- Uniform Protected Series Act

- Uniform Registration of Canadian Money Judgments Act

- Uniform Public Expression Protection Act

Jay's law practice is primarily in the area of creditor-debtor law, and he has served as a court-appointed receiver in two high-profile post-judgment enforcement matters: Gaggero v. Knapp Petersen and Wynn v. Francis. He was also the post-judgment enforcement counsel in Bay Guardian Co. v. New Times Media LLC which involved the collection of a $20+ million judgment against the parent entity of the Village Voice companies. His exploits in that case were later recounted in two articles:

- The Great West Coast Newspaper War, The Seattle Stranger (March 18, 2010); and

- Chasing the Money, California Lawyer (July, 2010).

Jay's office is in Las Vegas, but he practices throughout the Southwest United States and often consults with other attorneys on creditor-debtor matters nationwide.

- Jay D. AdkissonADKISSON PITET LLPPH: 702.953.9617EM: jay [at] apjuris.com