Tests Tests Mainuvta45tests

VOIDABLE TRANSACTION TESTS

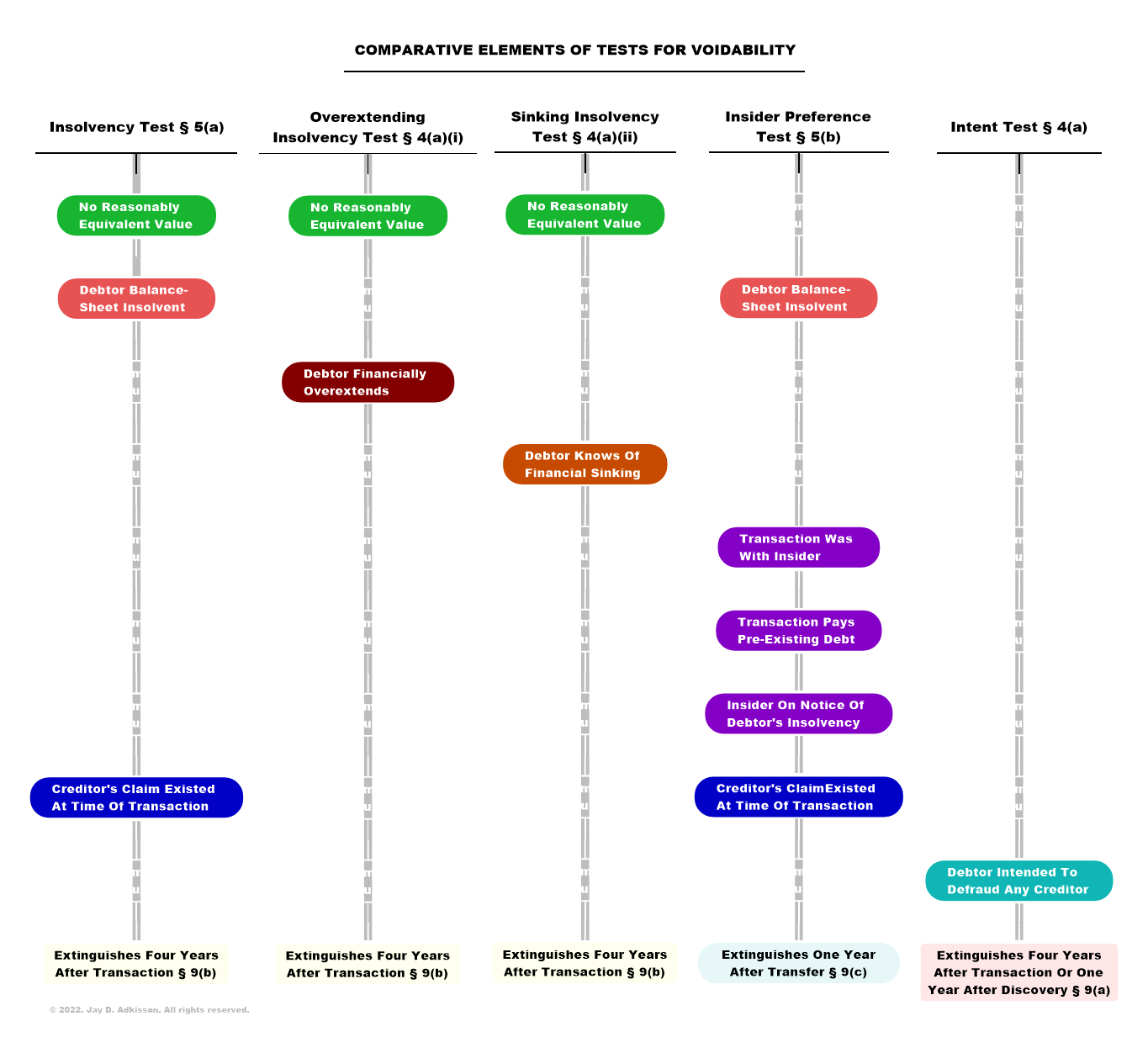

As set forth below, there are five tests (§§ 4(a)(1), (2)(i), (2)(ii), 5(a) and (b)) to determine if a fraudulent transfer has occurred. A comparison chart below demonstrates the element of each tests and how the tests differ. However, the vast majority of cases will in practice be decided by one of two tests:

- Insolvency Test: Was the Debtor insolvent (or rendered insolvent) at the time of the transfer, and did the Debtor receive "reasonably equivalent value" in exchange (§5(a), also known by the oxymoron "Constructive Fraudulent Transfer"); and

- Intent Test: Whether the Debtor intended to diminish the enforcement rights of creditors (§ 4(a)(1), also known by the oxymoron "Actual Fraudulent Transfer").

The slang terms for these tests, "Actual Fraudulent Transfer" and "Constructive Fraudulent Transfer", are oxymorons that are not at all descriptive of the analysis that is utilized by the UVTA. In fact, the use of these terms is counterproductive and confusing, and the better practice is to simply drop their usage altogether.

The Insolvency Test of §5(a) by its nature is often resolved on summary judgment, and (rather uniquely as a matter of litigation practice) frequently in favor of creditors. By contrast, the Intent Test of §4(a)(1) is almost invariably disputed (what debtor would admit to cheating creditors unless he wanted the transaction unwound?), leading to significant factual questions of intent, and thus normally precluding the granting of summary judgment.

Thus, the Insolvency Test is the "more certain" test between the two, and promises creditors the prospect of an early judgment that avoids the costs of prolonged litigation and trial. Creditors, therefore, quite naturally will assert and vigorously prosecute the Insolvency Test when they believe the facts are in their favor, and for this reason between the two tests of §§ 4(a)(1) and 5(a), it is the Insolvency Test that will ordinarily be measured first.

One might observe that there are really three forms of insolvency tests found in the UVTA, since the Overextending Insolvency Test of § 4(a)(i) and the Sinking Insolvency Test of § 4(a)(ii) effectively amount to "zone of insolvency" tests. With these latter two tests, perhaps the debtor isn't technically insolvent, but if there are certain other factors present then being close to insolvent is good enough.

The Insider Preference Test of § 5(b) is not really a fraudulent transfer test in the classic sense, but a preference test somewhat similar to that found in U.S. bankruptcy law. Recognizing this, some states, most notably California which has its own preferential transfer scheme, did not enact § 5(b) into their version of the UVTA.

IMPORTANT NOTE: For creditors the Intent Test is the least desirable test, to be used only as a fall-back alternative if none of the other tests can be satisfied. Creditors' counsel who are unfamiliar with this body of law will -- due to their inexperience in this area -- almost inevitably start with the Intent Test first, and start floundering around with the Badges of Fraud, which is more often than not the worst way to go about it.

Prefatory Note (UFTA 1984).

AVOIDABLE TRANSACTION TESTS LISTED

TEST ELEMENTS COMPARISON CHART

See also Article: J. Adkisson, Understanding The Elements Of The UVTA Tests For A Voidable Transaction, Forbes.com, 30 May 2019.

TESTS GENERALLY ARTICLES

- 2019.05.30 ... Understanding The Elements Of The UVTA Tests For A Voidable Transaction

- 2017.03.25 ... The UVTA Baedeker: Is The Transaction Voidable?